10 Best Forex Brokers in New Zealand

The Top 10 Best Forex Brokers in New Zealand revealed. We have rated and reviewed the best Forex Brokers accepting New Zealand Traders.

This is a complete listing of The 10 Best Forex Brokers in New Zealand. In this in-depth write-up you will learn:

- Who is the Best Suited Broker for Professional Traders

- Pros and Cons for Beginners.

- New Zealand Dollar Accounts and how they work.

- How is Forex Trading Regulated in New Zealand

and much, more.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

10 Best Forex Brokers in New Zealand (2024*)

- ☑️CMC Markets – Overall, Best Customer Service.

- ☑️AvaTrade – Award-winning trading platforms.

- ☑️XM – Low Spreads in New Zealand.

- ☑️BlackBull Markets – Multi-asset broker in 2024.

- ☑️IG – Best Award-winning platforms.

- ☑️ATC Brokers – Best ECN and STP brokers.

- ☑️FXTM – Best Award-winning Broker.

- ☑️Capital.com – Best user-friendly platform with MT4.

- ☑️ACY Securities – Offering ultra-low-cost trading.

- ☑️HFM – Licensed global broker in New Zealand.

Best Forex Brokers in New Zealand

| 👥 Brokers | 👉 Open Account | 💰 Minimum Deposit | ⚖️ Regulators | ✔️ Accepts New Zealand Traders |

| CMC Markets | 👉 Open Account | 33 NZD | FCA, ASIC, CySEC, NBRB, FSA | ✔️ |

| AvaTrade | 👉 Open Account | 165 NZD | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | ✔️ |

| XM | 👉 Open Account | 8 NZD | FSCA, IFSC, ASIC, CySEC, DFSA, FCA | ✔️ |

| BlackBull Markets | 👉 Open Account | 0 NZD | FMA, FSA | ✔️ |

| IG | 👉 Open Account | 410 NZD | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA | ✔️ |

| ATC Brokers | 👉 Open Account | 3,300 NZD | CIMA, FCA, NFA | ✔️ |

| FXTM | 👉 Open Account | 17 NZD | FCA, ASIC, CySEC, FSCA | ✔️ |

| Capital.com | 👉 Open Account | 33 NZD | FCA, ASIC, CySEC, NBRB, FSA | ✔️ |

| ACY Securities | 👉 Open Account | 82 NZD | ASIC, VFSC | ✔️ |

| HFM | 👉 Open Account | 0 NZD | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | ✔️ |

10 Best New Zealand Forex Brokers

CMC Markets

Who should use CMC Markets?

CMC Markets offers a comprehensive platform for Forex, indices, shares, ETFs, commodities, treasuries, and cryptocurrencies, providing advanced charting tools, premium charting, and Reuters live news.

What does CMC Markets do best?

CMC Markets offers MetaTrader 4 with fewer products and a customizable Next Generation platform. They offer liquidity and API pricing to institutions. Financial security is provided by holding all customer funds in New Zealand.

Where can CMC Markets improve?

There is a need for growth despite CMC Markets’ strengths. Educational information might be expanded, especially for beginners. The broker might benefit from offering more financial instruments and user-friendly tools for Novice traders.

CMC Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| A wide variety of trading instruments are accessible | Novice traders have limited instructional resources |

| Traders can access a proprietary platform, and MetaTrader 4 | MetaTrader 4 has a limited number of instruments |

| The FMA of New Zealand regulates the market | There is no 24/7 customer support |

| There is no minimum investment required | A smaller assortment of base currencies than some other brokers |

| Client funds are held onshore in New Zealand | Inactivity fees may be an issue for infrequent traders |

AvaTrade

Who should use AvaTrade?

AvaTrade is ideal for traders who want a well-regulated platform focusing on Forex and CFD trading.

What does AvaTrade do best?

They provide a wide range of assets and trading platforms, including MetaTrader 4 and 5, to meet various trading demands. AvaTrade is well-known for its high-quality instructional services through SharpTrader and its diverse asset choices, allowing cross-asset diversification.

Where can AvaTrade improve?

AvaTrade offers competitive trading costs but not the lowest in the market, with a product selection limited to Forex, CFDs, cryptocurrency, and high spreads.

AvaTrade Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade provides free deposit and withdrawal alternatives, as well as useful research tools | The product selection is limited, with a concentration on CFDs, Forex, and cryptocurrency |

| They offer a wide choice of trading platforms to suit a variety of trading preferences | Higher inactivity costs than other brokers |

| SharpTrader offers high-quality educational resources | The forex fees are minimal, but the CFD trading fees are high |

| Multiple authorities regulate it effectively, ensuring a secure trading environment | AvaTrade’s trading costs may not be the most budget-friendly for all traders |

| AvaTrade provides free deposit and withdrawal alternatives, as well as useful research tools | The inactivity cost is charged periodically and is expensive |

XM

Who should use XM?

XM offers 16 trading platforms, including MetaTrader 4 and 5, and various teaching materials, making it ideal for traders seeking low minimum deposit limits and zero spread options.

What does XM do best?

XM offers instructional services for novice traders, offering low stock CFD and withdrawal costs, making it an attractive option for diversifying trading methods beyond FX.

Where can XM improve?

XM’s current trading instrument portfolio consists of CFD and forex trading, with average costs and a lack of investment protection for clients outside the EU.

XM Pros and Cons

| ✔️ Pros | ❌ Cons |

| Low minimum deposit requirements make it accessible to newcomers | A limited product selection focuses mostly on CFDs and Forex |

| A diverse set of teaching tools and materials | Forex and stock index CFDs have average costs |

| There are no withdrawal costs in most circumstances | There is no investment protection for non-EU clients |

| Provides negative balance protection | If an account is not used for more than a year, it will incur an inactivity fee |

| Allows access to both the MT4 and MT5 platforms | While withdrawals are normally free, fees may apply for bank withdrawals under a particular amount |

BlackBull Markets

Who should use BlackBull Markets?

BlackBull Markets provides a comprehensive ECN broker experience for Forex and CFD traders, offering competitive spreads and various account types, including ECN Prime and Institutional accounts.

What does BlackBull Markets do best?

BlackBull Markets’ MT4 and MT5 MetaTrader platforms and social trading capabilities let traders mimic expert traders’ tactics. They offer a swap-free Islamic account for Sharia-compliant traders.

Where can BlackBull Markets improve?

They could expand their research tools and instructional materials to give traders more market analysis and learning chances. Although their customer assistance is well-rated, some users have experienced response time irregularities.

BlackBull Markets Pros and Cons

| ✔️ Pros | ❌ Cons |

| Competitive commissions for ECN Institutional accounts | Educational and research tools could expand |

| A robust MetaTrader platform for trading methods | Users complain of irregular customer support response times |

| Multiple account types for different trading methods | CFDs and Forex were the main options, with few alternative investments |

| Swap-free Islamic accounts exist | No matter the withdrawal method, a $5 withdrawal fee is charged |

| New Zealand’s FMA regulates, ensuring trust and safety | Higher initial deposits are needed for institutional accounts |

IG

Who should use IG?

IG offers a user-friendly, efficient platform for forex traders, catering to desktop and mobile users. It offers sophisticated tools and indications for both beginners and experienced traders.

What does IG do best?

IG is known for its excellent web trading platform and instructional materials. Traders who prefer flexibility and mobility love their comprehensive mobile app, which offers full trading features in a streamlined format.

Where can IG improve?

However, there are several areas in which IG could improve. The broker’s trading fees are quite hefty, particularly for stock CFDs. Furthermore, their product variety on the MetaTrader 4 platform is limited, and their customer service has been acknowledged to be slower than optimal.

IG Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a vast range of screening instruments and indications available | Inactivity costs occur after a period of inactivity |

| Excellent mobile app that reflects the features of the desktop platform | MetaTrader 4 offers a limited variety of items |

| The fee structure for Forex trading is straightforward and obvious | High stock CFD trading fees |

ATC Brokers

Who should use ATC Brokers?

ATC Brokers is a MetaTrader 4 platform-focused brokerage service offering ECN execution, tight spreads, and direct market access to traders.

What do ATC Brokers do best?

ATC Brokers is well-known for offering an MT Pro plugin for the MT4 trading platform, which improves the trading experience with additional capabilities. They also provide PAMM accounts, which enable traders to benefit from pooled funds for trading.

Where can ATC Brokers improve?

ATC Brokers is known for having high minimum trading capital requirements and limited payment choices. Furthermore, they impose large withdrawal costs, which may disadvantage traders who need to transfer funds frequently.

ATC Broker’s Pros and Cons

| ✔️ Pros | ❌ Cons |

| Fully regulated, providing a secure trading environment | The high minimum deposit requirement may provide a hurdle for some traders |

| Includes the popular MT4 trading platform as well as the MT Pro plugin | There are limited payment methods for deposits and withdrawals |

| Provides the ECN execution model, which is popular due to its transparency | High withdrawal fees, especially for international wire transactions |

| Regular market news updates | There is a limited selection of instruments. |

| There are no commission fees for trading CFDs |

FXTM

Who should use FXTM?

FXTM is a broker that offers MT4 and MT5 platforms, renowned for their reliability, bespoke indicators, and professional advisors, catering to new and experienced traders.

What does FXTM do best?

FXTM is known for its inexpensive Forex and CFD costs, quick and digital account opening process, and attentive customer support. This makes them an attractive option for traders seeking low-cost trading and efficient service.

Where can FXTM improve?

FXTM’s educational and training services are not as advanced as some traders, particularly those new to forex trading. Furthermore, their product offering is limited, focusing mostly on Forex and CFDs, and they impose both an inactivity fee and a withdrawal cost.

FXTM Pros and Cons

| ✔️ Pros | ❌ Cons |

| Low trading and non-trading fees. | Inactivity and withdrawal costs apply |

| Accounts can be opened quickly and digitally | There are limited educational services available |

| Good client service | Limited product selection |

| You can choose between MT4 and MT5 | There is no cTrader platform integration |

| Low forex and CFD fees |

Capital.com

Who should use Capital.com?

Capital.com is ideal for traders who want a platform that is both user-friendly and offers a variety of trading alternatives, including Forex and CFDs.

What does Capital.com do best?

Their platform is great for those who like a simple, easy-to-use trading environment. They stand out for their straightforward cost structure, which includes commission-free trading and competitive spreads, notably in currency trading.

Where can Capital.com improve?

Capital.com could enhance its trading experience by expanding account-based currency options and enhancing trading interface customization, including price notifications.

Capital.com Pros and Cons

| ✔️ Pros | ❌ Cons |

| A transparent broker with detailed fee disclosures and no deposit costs | There is a limited number of basic currencies accessible for accounts |

| Provides a user-friendly online and mobile trading platform | Their trading software has only a few customization options, especially for charts and workspaces |

| Provides a diverse choice of trading products, including many Forexes and cryptocurrencies. | There is a lack of price alerts on the web trading platform |

| There are no withdrawal fees, and you can deposit via bank transfers, credit/debit cards, or e-wallets such as PayPal | The platform does not accept MT4 add-ons, which limits the alternatives for algorithmic traders |

| Competitive trading expenses, including tight spreads and commission-free trading on important pairs such as EUR/USD | VPS hosting and Islamic accounts are not available |

ACY Securities

Who should use ACY Securities?

ACY Securities is ideal for traders searching for a broker that provides diverse trading products, such as Forex, commodities, indices, cryptocurrencies, and stocks as CFDs. They benefit traders who like to use the MetaTrader 4 and MetaTrader 5 platforms.

What does ACY Securities do best?

ACY Securities excels at offering competitive trading circumstances, such as tight spreads, low costs, and high leverage choices. They also provide several account kinds to accommodate different trading styles and tactics.

Where can ACY Securities improve?

ACY Securities can improve in areas such as instructional resources, which are currently restricted and may not adequately meet the needs of beginners. Furthermore, their customer support services should be improved to provide more comprehensive and timely assistance.

ACY Securities Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a varied portfolio of tradable instruments | Novice traders have limited instructional resources |

| Competitive spreads and affordable trading fees | Customer service could be more responsive |

| Provides both MetaTrader 4 and MetaTrader 5 platforms | The scope of research instruments could be broadened |

| High leverage alternatives are available | There is no bespoke trading platform for traders seeking a distinctive trading experience |

| Multiple account types are available to meet a variety of trading needs | Some traders may find the account verification process onerous |

HFM

Who should use HFM?

HFM is a forex broker catering to all traders, offering various account types, platforms like MetaTrader 4 and 5, and its copy trading tool, HFCopy.

What does HFM do best?

HFM offers diverse account options, negative balance protection, global reach, and civil liability insurance, catering to various trading techniques and tastes.

Where can HFM improve?

HFM’s regular account spreads are less competitive, especially for specific currency pairs, and their ECN or RAW accounts offer better value for major pairs. Still, spreads can widen for less prevalent pairs.

HFM Pros and Cons

| ✔️ Pros | ❌ Cons |

| A wide range of account kinds, including micro and zero-spread accounts | Spreads for standard accounts are less competitive for some pairings |

| Negative balance protection ensures safer trading | Better spreads on major pairs, especially on ECN/RAW accounts, with wider spreads on less prevalent pairings |

| Global accessibility, serving a diverse range of regions | Services such as high leverage are provided through offshore organizations |

| Additional civil liability insurance to protect client funds | Advanced traders might want more than just educational and research tools |

| A wide range of account types, including micro and zero-spread accounts |

How to Choose a Forex Broker in New Zealand

When selecting a Forex broker in New Zealand, traders need to consider key elements to ensure compliance with local financial norms and regulatory standards:

- Prioritize brokers regulated by New Zealand’s Financial Markets Authority (FMA). This assures compliance with local regulatory norms, providing an extra degree of security and integrity in trading operations.

- Look for brokers who provide responsive customer service, preferably local support, and understand the New Zealand market situation.

- For beginners, thorough educational resources and market research help them learn forex trading dynamics.

- Consider the many account types and minimum deposit criteria to match your trading style and capital availability.

- Understand the available leverage alternatives and ensure they match your risk tolerance and trading strategy.

- Look for easy deposit and withdrawal alternatives with low or no transaction costs.

- Look into user reviews and testimonials to determine the broker’s reputation in the New Zealand trading community.

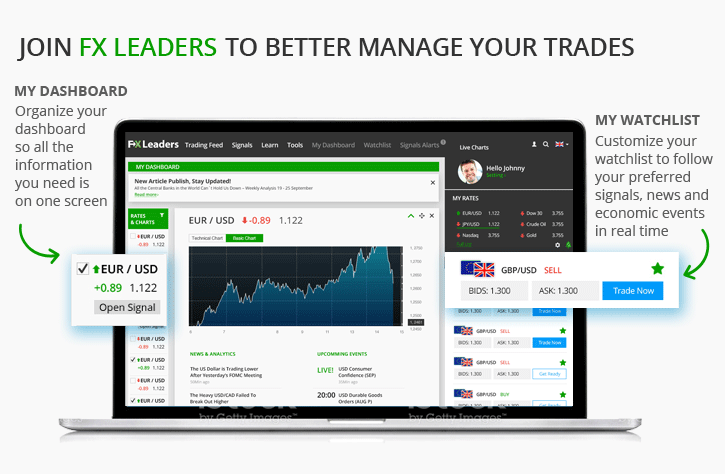

- Evaluate the broker’s trading platforms in terms of usability and toolset. Popular platforms like MetaTrader 4 and 5 are preferred for their extensive functionality and robustness.

- Compare the spreads and trading fees of various brokers. Competitive spreads and low transaction costs are critical to increasing trading efficiency.

- Ensure the broker offers a wide choice of currency pairs, particularly NZD pairs, to capitalize on local market knowledge.

Frequently Asked Questions

Who is the Best Forex Broker in New Zealand?

The best Forex broker in New Zealand is highly subjective and depends on the individual’s trading requirements. XM, CMC Markets, HFM, AvaTrade, and other brokers are popular in New Zealand.

What is the Best Forex Trading Platform in New Zealand?

MetaTrader 4 and MetaTrader 5 are the top trading platforms in New Zealand due to their comprehensive features, dependability, and widespread use among brokers.

Is Forex legal in New Zealand?

Forex trading is allowed in New Zealand and regulated by the Financial Markets Authority (FMA), providing a secure trading environment.

Who is the Best Forex Broker for Beginners in New Zealand?

Beginners in New Zealand generally choose brokers like IG and CMC Markets for their user-friendly platforms and rich educational tools.

Who is the Best Forex Broker for Professional Traders in New Zealand

Professional traders in New Zealand may pick brokers such as IG or BlackBull Markets, which offer diverse trading products and powerful platforms.

How is Forex Trading Regulated in New Zealand?

The Financial Markets Authority (FMA) regulates forex trading in New Zealand, ensuring that brokers follow strict financial regulations and policies to protect traders.